What is SIP? Brief Explanation . Should you Do It?

Introduction:

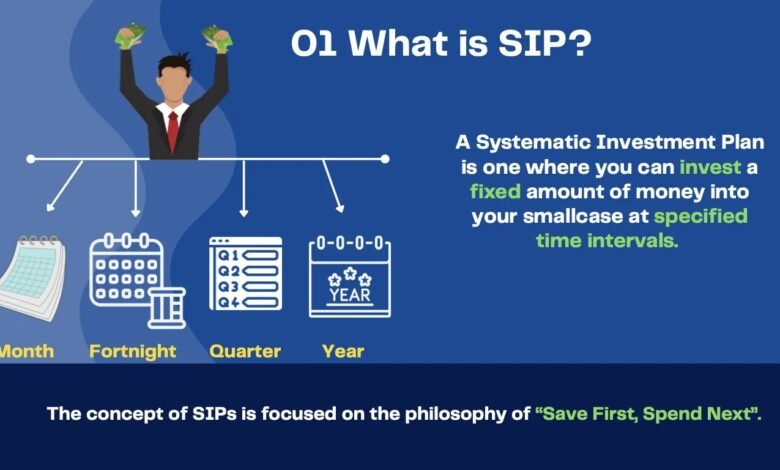

What is Sip?

Sip, or Systematic Investment Plan, is a restrained way to contribute a fixed sum in shared stores regularly—monthly, quarterly, or indeed week by week. Sips are the go-to procedure for modern and prepared investors alike, offering straightforwardness, reasonableness, and the advantage of rupee cost averaging.

Benefits of Sip

Disciplined Investment Habit

Sips instill a standard reserve funds and contributing propensity, vital for riches creation over the long term.

Rupee Cost Averaging

When markets are high, your Sip buys less units; when low, it buys more. Over time, this diminishes the normal cost per unit.

Power of Compounding

Early and regular investments through Sip can essentially advantage from the power of compounding.

Reasonable and Adaptable

Begin with as low as ₹500/month. Increase or halt anytime—SIPs are highly adaptable.

No Market Timing Required

Sips expel the ought to time the market, diminishing passionate and rash contributing choices.

Sorts of Sips

Regular Sip

Fixed amount invested at standard intervals.

Top-Up Sip

Permits you to extend your Sip contribution occasionally.

Adaptable Sip

Adjust the Sip sum based on your cash flow.

Never-ending Sip

No settled conclusion date; proceeds until you halt it.

Trigger Sip

Based on market events or NAV levels; more progressed and less secure.

How to Begin Sip?

Characterize Your Objectives

Know what you’re saving for—retirement, education, home, etc.

Select the Correct Mutual Fund

Pick a fund that adjusts along with your risk craving and monetary objectives.

Decide the Sip Sum and Recurrence

Be reasonable and steady together with your investment.

Total KYC Process

Mandatory Know Your Client (KYC) compliance through Pan, address confirmation, etc.

Set Up the Sip Online or Offline

Utilize your mutual fund’s entry, wholesaler, or mobile apps to start.

Who Ought to Contribute in Sip?

Salaried people

First-time speculators

- Individuals with long-term money related objectives

- Speculators who prefer minimal showcase inclusion cash

- Passionate Inclination Negligible Higher chances

ऑपरेशन सिंदूर: भारतीय वायुसेना की रणनीतिक चाल और ब्रह्मोस मिसाइलों की विध्वंसक शक्ति